Let’s first turn to the obvious negatives. The Trump idea is an admission that he and pretty much everyone are unserious about addressing the housing unaffordability problem because too many powerful players benefit from it. The most obvious remedy is to build more middle/lower middle class residences in high cost areas. But right away, that runs hard into NIMBYism: all those well off with their tony houses don’t want the servant classes or even dull normals living nearby and possibly harming their property prices.

… the popular freely-refinancable (as in no prepayment penalty) 30 year fixed rate mortgage is a very unnatural product and is found in comparatively few advanced. economies. On paper, it puts the interest rate risk on the lender. If rates drop, borrowers refinance, taking the loan away from creditors just when taking the risk of longer-dated loans is paying off. There are many ways to better share the interest rate risk, such as barring refis for the first five to seven years of a mortgage, or having interest rates float subject to a floor and ceiling. I had that sort of product in the early 1980s and was very happy with it. You can pencil out what your worst-case mortgage costs might be and benefit with no expenditure of effort if interest rates fall.

So why is this supposedly borrower-favoring feature, of the “freely refinancable” fixed rate mortgage, actually not good for borrowers? Because that option is NOT free! Not only do borrowers pay fees when they refinanace, but lenders have succeeded in structuring refis so that roughly 2/3 of the economic benefit of the refi is captured by financiers, not by the homeowner.

A related bad feature of the refinancable 30 year mortgage is that it increases systemic risk. Mortgage guarantors Fannie and Freddie have to hedge the refi risk. That hedging is pro-cyclical on a systemically disrupting scale.

…

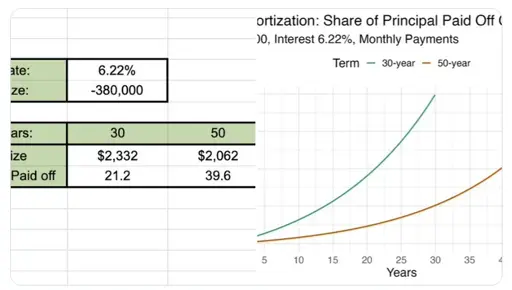

50 year mortgages, compared to a 30 year obligation have more of their payments over their life in interest. That means in a refi more total interest savings. That means even more in fee extraction by middlemen! More critically, it also means much greater pro-cyclical hedging action, and thus an even bigger increase in systemic risk, assuming that there actually was consumer receptivity to this bad idea…

No one in the us ever looks at how things work in other countries, right?

While we don’t have the exact same mortgages setup in the EU, it’s not in any way uncommon for our house loans to not be realistically paid down during one’s life time. Yeah, we indeed refer to it as renting from the banks.

I looked it up and France is 20 as the most common with generally up to 25. Spain is 20 average with 25-30 and max of 40. Italy, Germany and even the UK are in that range with UK being the longest now with 31-32 capping out at 40 generally. 50 is not normal for comparable countries. Are you suggesting that in your country 50 is normal?

Sherrif eviction.